Contents:

Key Odyssey Network Indicators

Shipper Actions

In today’s competitive environment, becoming a preferred shipper to carriers can help improve attaining sufficient capacity. Things that shippers offer that help reach this status can include:

Accuracy:

-

Forecast for the end of month/end of quarter – plan for surges in your needs to ensure coverage

-

Develop order lead time – at least 5 days in advance. ask carriers for “best case” options

Specificity:

-

Request delivery windows from customers…often 8 a.m. deliveries are requested when product really is not need until much later. A window of 8-10 a.m. may have a better chance of coverage.

-

Spread delivery times across the day

-

Assess what your customers really need. Make sure that customer delivery requirements are up to date and accurate. Do not require equipment/assessorials that are not needed

Flexibility:

- Offer flexible load times

- Explore/ be open to mode options including intermodal

Driver-friendliness:

- Load/unload within the normal 2 hours-time is money to drivers

- Provide creature comforts (clean restrooms, rest areas, free Wi-Fi, a cup of coffee, etc.)

Consistency:

- Offer consistent volume that carriers can plan against

- Reduce order changes – a new date may put coverage at risk

Efficiency:

- Maximize payload on trucks

- Utilize trailer drop yards at high volume origins when possible

- Prioritize loading/unloading trucks quickly at facilities

Promptness:

- Pay carriers within their contracted freight terms- cash flow is vital to carriers

Economic Update

GDP Change

Gross Domestic Product | U.S. Bureau of Economic Analysis (BEA)

- Real gross domestic product (GDP) decreased at an annual rate of 0.2 percent in the first quarter of 2025 (January, February, and March), according to the second estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent.

- The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending.

- These movements were partly offset by increases in investment, consumer spending, and exports.

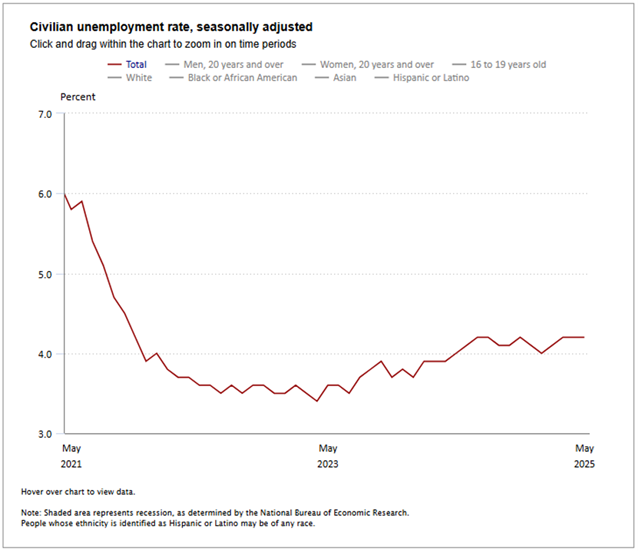

Unemployment

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

- Total non-farm payroll employment increased by 139,000 in May, and the unemployment rate was unchanged at 4.2 percent, the U.S. Bureau of Labor Statistics reported today.

- Employment continued to trend up in health care, leisure and hospitality, and social assistance. Federal government continued to lose jobs.

- This news release presents statistics from two monthly surveys.

- The household survey measures labor force status, including unemployment, by demographic characteristics.

- The establishment survey measures non-farm employment, hours, and earnings by industry.

Household Survey Data

- The unemployment rate held at 4.2 percent in May and has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024.

- The number of unemployed people, at 7.2 million, changed little over the month.

- The number of long-term unemployed (those jobless for 27 weeks or more) decreased over the month by 218,000 to 1.5 million. The long-term unemployed accounted for 20.4 percent of all unemployed people in May.

- In May, the employment-population ratio declined by 0.3 percent to 59.7 percent. The labor force participation rate decreased by 0.2 percent to 62.4 percent.

- The number of people employed part time for economic reasons, at 4.6 million, changed little in May. These individuals would have preferred full-time employment but were working part-time because their hours had been reduced or they were unable to find full-time jobs.

Establishment Survey Data

- Total non-farm payroll employment increased by 139,000 in May, similar to the average monthly gain of 149,000 over the prior 12 months. In May, employment continued to trend up in health care, leisure and hospitality, and social assistance. Federal government continued to lose jobs.

- Health care added 62,000 jobs in May, higher than the average monthly gain of 44,000 over the prior 12 months. In May, job gains occurred in hospitals (+30,000), ambulatory health care services (+29,000), and skilled nursing care facilities (+6,000).

- Employment in leisure and hospitality continued to trend up in May (+48,000), largely in food services and drinking places (+30,000). Over the prior 12 months, leisure and hospitality had added an average of 20,000 jobs per month.

- In May, social assistance employment continued to trend up (+16,000), reflecting continued growth in individual and family services (+16,000).

- Federal government employment continued to decline in May (-22,000) and has been down by 59,000 since January. (Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

- Average hourly earnings for all employees on private non-farm payrolls rose by 15 cents, or 0.4 percent, to $36.24 in May. Over the past 12 months, average hourly earnings have increased by 3.9 percent. In May, average hourly earnings of private-sector production and nonsupervisory employees rose by 12 cents, or 0.4 percent, to $31.18.

U.S. Truck Transportation Employment

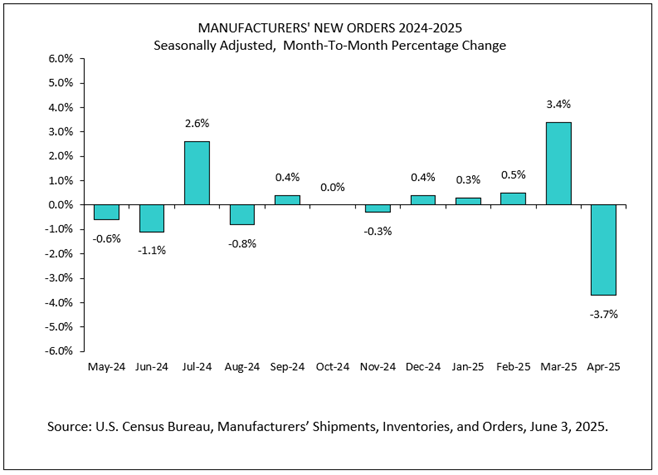

Manufactured Goods – New Orders

https://www.census.gov/manufacturing/m3/current/index.html

Monthly Full Report on Manufacturers’ Shipments, Inventories, & Orders

(Released June 3, 2025)

- New orders for manufactured goods in April, down following four consecutive monthly increases, decreased $22.8 billion or 3.7 percent to $594.6 billion, the U.S. Census Bureau reported today. This followed a 3.4 percent March increase.

- Shipments, down two consecutive months, decreased $1.8 billion or 0.3 percent to $598.9 billion. This followed a 0.2 percent March decrease.

- Unfilled orders, up seven of the last eight months, increased $2.1 billion or 0.1 percent to $1,402.7 billion. This followed a 0.2 percent January increase.

- Unfilled orders, up eleven of the last twelve months, increased $0.7 billion or virtually unchanged to $1,408.5 billion. This followed a 1.6 percent March increase. The unfilled orders-to-shipments ratio was 6.77, down from 6.86 in March. Inventories, down following six consecutive monthly increases, decreased $0.5 billion or 0.1 percent to $943.6 billion. This followed a 0.1 percent March increase.

- The inventories-to-shipments ratio was 1.58, up from 1.57 in March.

Transportation Update

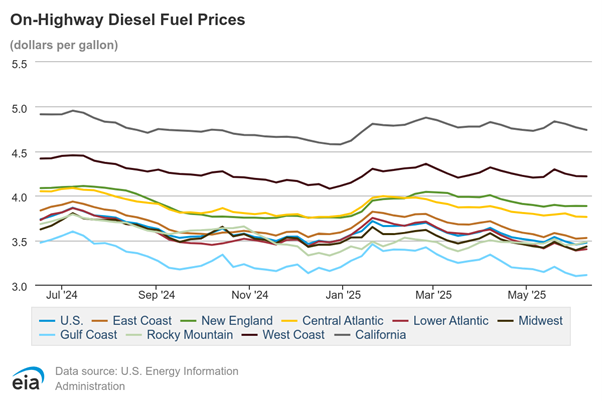

Fuel

https://www.eia.gov/petroleum/gasdiesel/?os=frefapp

The national average price of diesel for the week of May 26 stood at $3.49 per gallon, a decrease of 2 cents from four weeks prior at the end of April and down $0.187 from a year ago.

Transportation Capacity

- The Transportation Capacity Index decreased .5 points to 54.7 percent in May 2025.

- Transportation Capacity falls to a level that is 2.6 points lower than 1 year ago and 14.6 points from two year ago. As such, while the Transportation Capacity index remains in the slight expansion territory, it is relatively subdued when compared to seasonal data for the last two years.

- While the Upstream Transportation Capacity index at 50.0, the Downstream index is significantly higher at 65.3.

- The future Transportation Capacity index also ticked slightly lower, and it is now at 50.0, indicating stable capacity for next 12 months. While the future Upstream index is at 46.2, the Downstream Transportation Capacity index is at 59.7, and the difference is statistically significant. Hence, the Transportation Capacity seems to be continuing to tighten Upstream while it is more relaxed, and it is expected to remain somewhat looser Downstream.

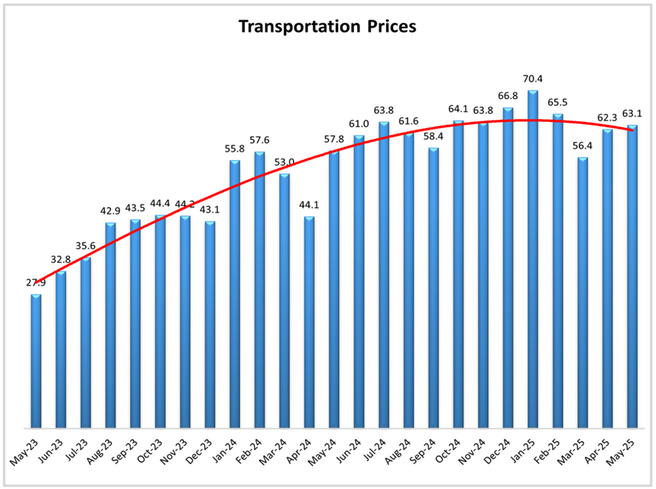

Transportation Prices

May 2025 Logistics Managers’ Index – LOGISTICS MANAGERS’ INDEX

- The Transportation Prices Index increased 0.8 points from the previous reading and recorder 63.1 in May 2025.

- The Upstream Transportation Prices Index is at 61.7, and the Downstream index is at 66.7, but the difference is not significant, indicating that the price increases are felt across the supply chain.

- The future Transportation Utilization Index rebounds slightly (4.1 points) from last month, remaining in the expansion territory and indicating the 60.9 level for the next 12 months. There is not much difference between Upstream and Downstream, with the future Upstream Transportation Utilization index at 61.5 and the Downstream index at 59.7.

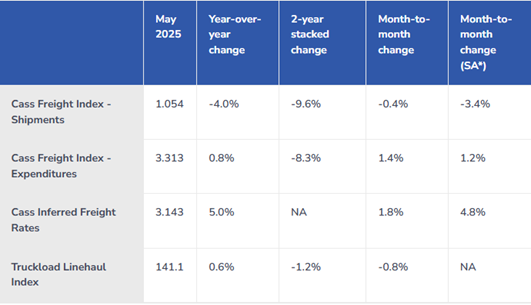

Cass Freight & Truckload Index

Uncertainty Reigns

Source: Cass Information Systems, Inc.

Cass Transportation Index Report | May 2025 | Cass Information Systems

Cass Transportation Index Report | May 2025 | Cass Information Systems

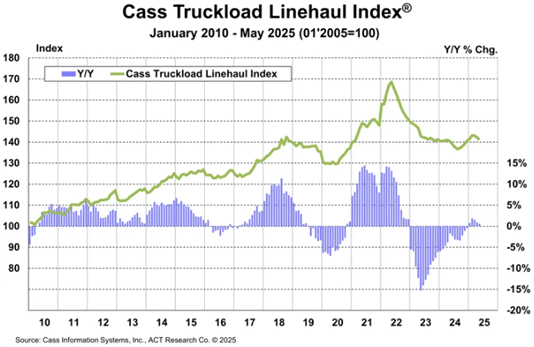

The Cass Truckload Linehaul Index is a measure of market fluctuations in per-mile truckload linehaul rates, independent of additional cost components such as fuel and accessorials.

The Cass Truckload Linehaul Index fell 0.8% month over month in May, after a 0.5% decline in April.

- The y/y increase slowed to 0.6% in May from 0.9% in April, as rate momentum in the truckload market stalled. Pre-tariff shipping was not enough to tighten the market balance even as seasonality improved in May.

- This index fell 10% in 2023, another 3.4% in 2024, and is on track for a small increase in 2025.

Truck Tonnage Index

ATA Truck Tonnage Index for May will be published on July 10, 2025.

National Spot Rates

Source: DAT Analytics | https://www.dat.com/trendlines

The chart above depicts national average rates (including fuel surcharges) in the past 13 months, derived from DAT RateView.