Contents:

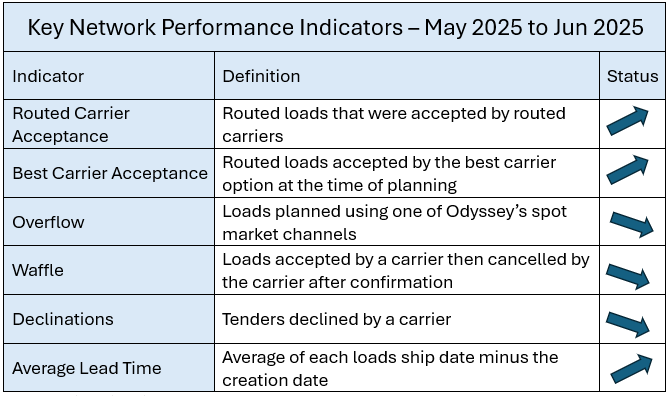

Key Odyssey Network Indicators

Shipper Actions

In today’s competitive environment, becoming a preferred shipper to carriers can help improve attaining sufficient capacity. Things that shippers offer that help reach this status can include:

Accuracy:

-

Forecast for the end of month/end of quarter – plan for surges in your needs to ensure coverage

-

Develop order lead time – at least 5 days in advance. ask carriers for “best case” options

Specificity:

-

Request delivery windows from customers…often 8 a.m. deliveries are requested when product really is not need until much later. A window of 8-10 a.m. may have a better chance of coverage.

-

Spread delivery times across the day

-

Assess what your customers really need. Make sure that customer delivery requirements are up to date and accurate. Do not require equipment/assessorials that are not needed

Flexibility:

- Offer flexible load times

- Explore/ be open to mode options including intermodal

Driver-friendliness:

- Load/unload within the normal 2 hours-time is money to drivers

- Provide creature comforts (clean restrooms, rest areas, free Wi-Fi, a cup of coffee, etc.)

Consistency:

- Offer consistent volume that carriers can plan against

- Reduce order changes – a new date may put coverage at risk

Efficiency:

- Maximize payload on trucks

- Utilize trailer drop yards at high volume origins when possible

- Prioritize loading/unloading trucks quickly at facilities

Promptness:

- Pay carriers within their contracted freight terms- cash flow is vital to carriers

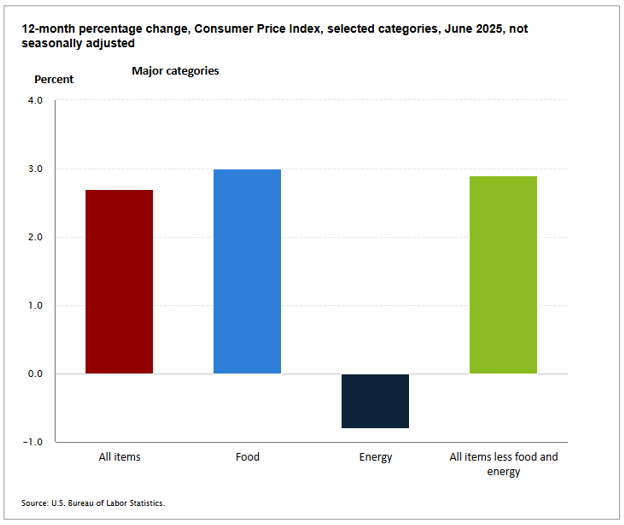

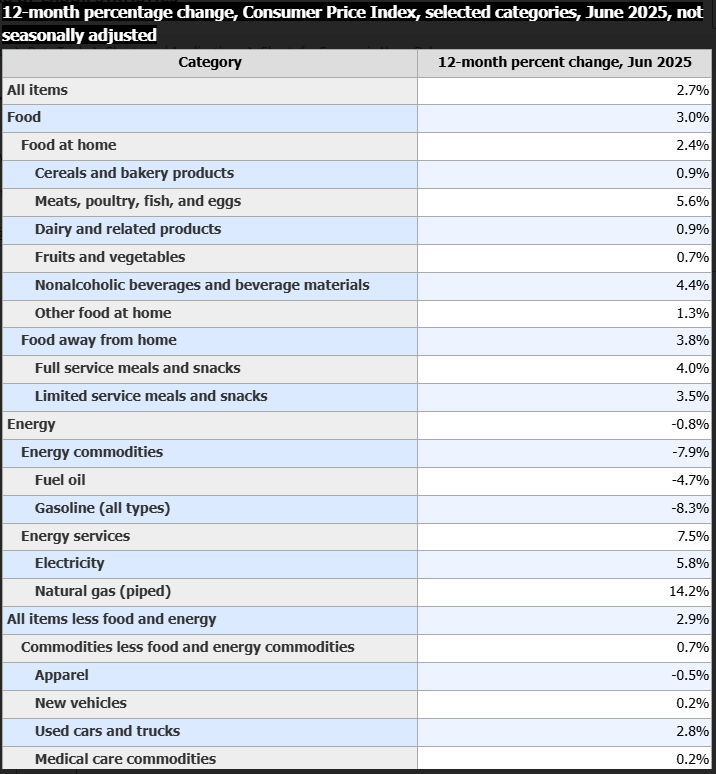

Economic Update

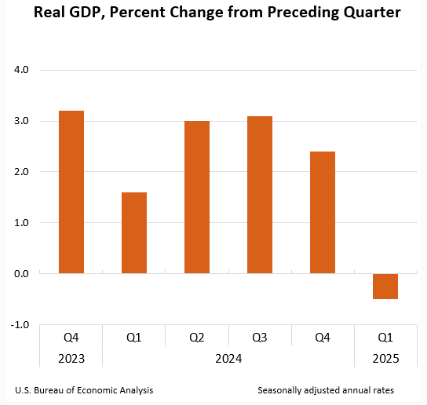

GDP Change

Gross Domestic Product | U.S. Bureau of Economic Analysis (BEA)

- Real gross domestic product (GDP) decreased at an annual rate of 0.5 percent in the first quarter of 2025 (January, February, and March), according to the third estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent.

- The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending.

- These movements were partly offset by increases in investment and consumer spending.

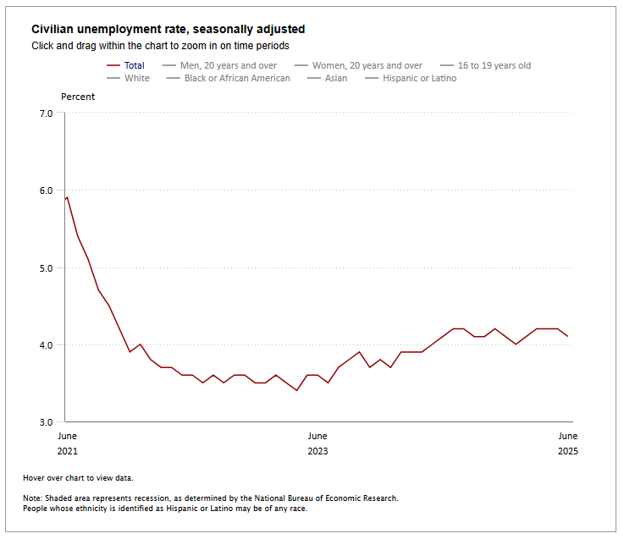

Unemployment

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

- Total non-farm payroll employment increased by 147,000 in June, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today.

- Job gains occurred in state government and health care. Federal government continued to lose jobs.

- This news release presents statistics from two monthly surveys.

- The household survey measures labor force status, including unemployment, by demographic characteristics.

- The establishment survey measures non-farm employment, hours, and earnings by industry.

Household Survey Data

- Both the unemployment rate, at 4.1 percent, and the number of unemployed people, at 7.0 million, changed little in June.

- The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024.

- In June, the number of long-term unemployed (those jobless for 27 weeks or more) increased by 190,000 to 1.6 million, largely offsetting a decrease in the prior month. The long-term unemployed accounted for 23.3 percent of all unemployed people.

- The labor force participation rate changed little at 62.3 percent in June, and the employment population ratio held at 59.7 percent.

- The number of people employed part time for economic reasons, at 4.5 million, changed little in June. These individuals would have preferred full-time employment but were working part-time because their hours had been reduced or they were unable to find full-time jobs.

Establishment Survey Data

- Total non-farm payroll employment increased by 147,000 in June, in line with the average monthly gain of 146,000 over the prior 12 months. In June, job gains occurred in state government and health care. Federal government continued to lose jobs.

- Health care added 39,000 jobs in June, similar to the average monthly gain of 43,000 over the prior 12 months. In June, job gains occurred in hospitals (+16,000) and in nursing and residential care facilities (+14,000).

- In June, social assistance employment continued to trend up (+19,000), reflecting continued growth in individual and family services (+16,000).

- Government employment rose by 73,000 in June. Employment in state government increased by 47,000, largely in education (+40,000). Employment in local government education continued to trend up (+23,000). Job losses continued in federal government (-7,000), where employment is down by 69,000 since reaching a recent peak in January. (Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; and other services.

- Average hourly earnings for all employees on private non-farm payrolls rose by 8 cents, or 0.2 percent, to $36.30 in June. Over the past 12 months, average hourly earnings have increased by 3.7 percent. In June, average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $31.24.

U.S. Truck Transportation Employment

Manufactured Goods – New Orders

https://www.census.gov/manufacturing/m3/current/index.html

Monthly Full Report on Manufacturers’ Shipments, Inventories, & Orders

(Released July 3, 2025)

- New orders for manufactured goods in May, up five of the last six months, increased $48.5 billion or 8.2 percent to $642.0 billion, the U.S. Census Bureau reported today. This followed a 3.9 percent April decrease.

- Shipments, up following two consecutive monthly decreases, increased $0.7 billion or 0.1 percent to $599.4 billion. This followed a 0.3 percent April decrease.

- Unfilled orders, up seven of the last eight months, increased $2.1 billion or 0.1 percent to $1,402.7 billion. This followed a 0.2 percent January increase.

- Unfilled orders, up ten of the last eleven months, increased $47.7 billion or 3.4 percent to $1,455.4 billion. This followed a virtually unchanged April decrease. The unfilled orders-to-shipments ratio was 6.98, up from 6.77 in April. Inventories, up seven of the last eight months, increased $0.8 billion or 0.1 percent to $944.1 billion. This followed a 0.1 percent April decrease.

- The inventories-to-shipments ratio was 1.58, unchanged from April.

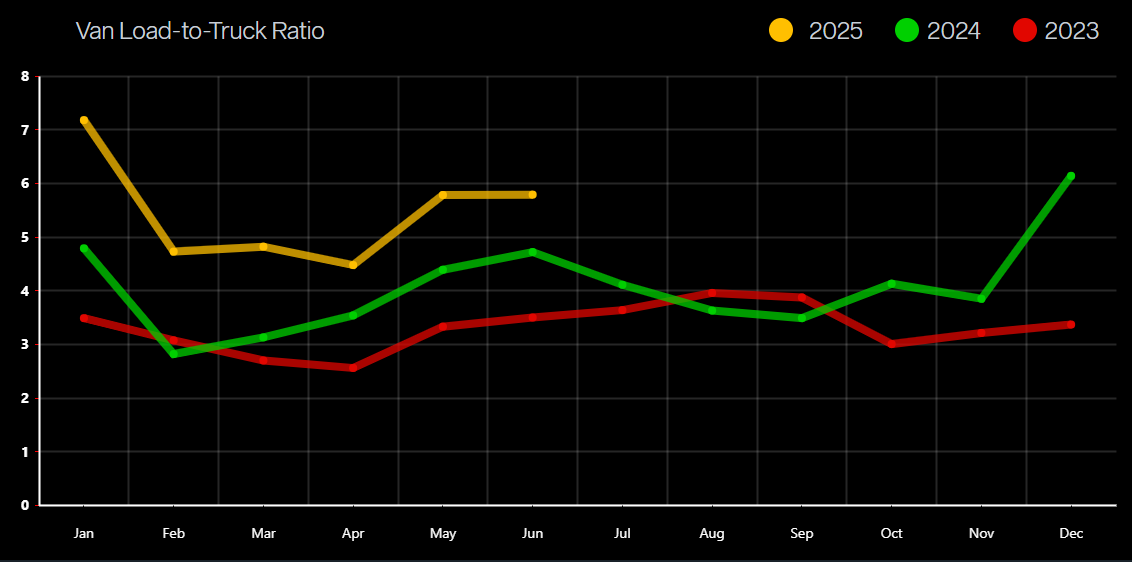

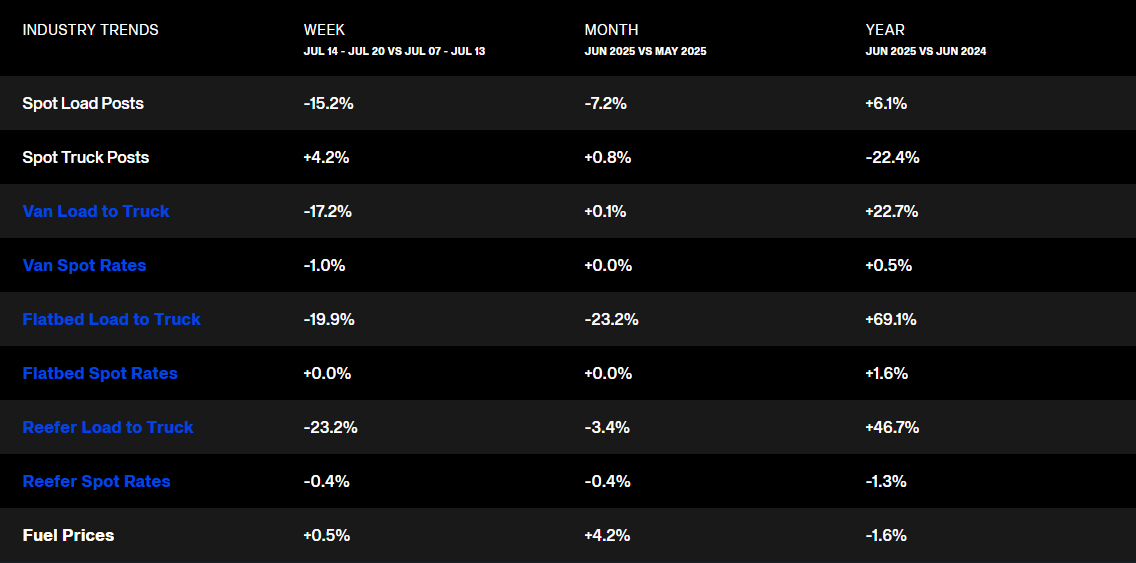

Transportation Update

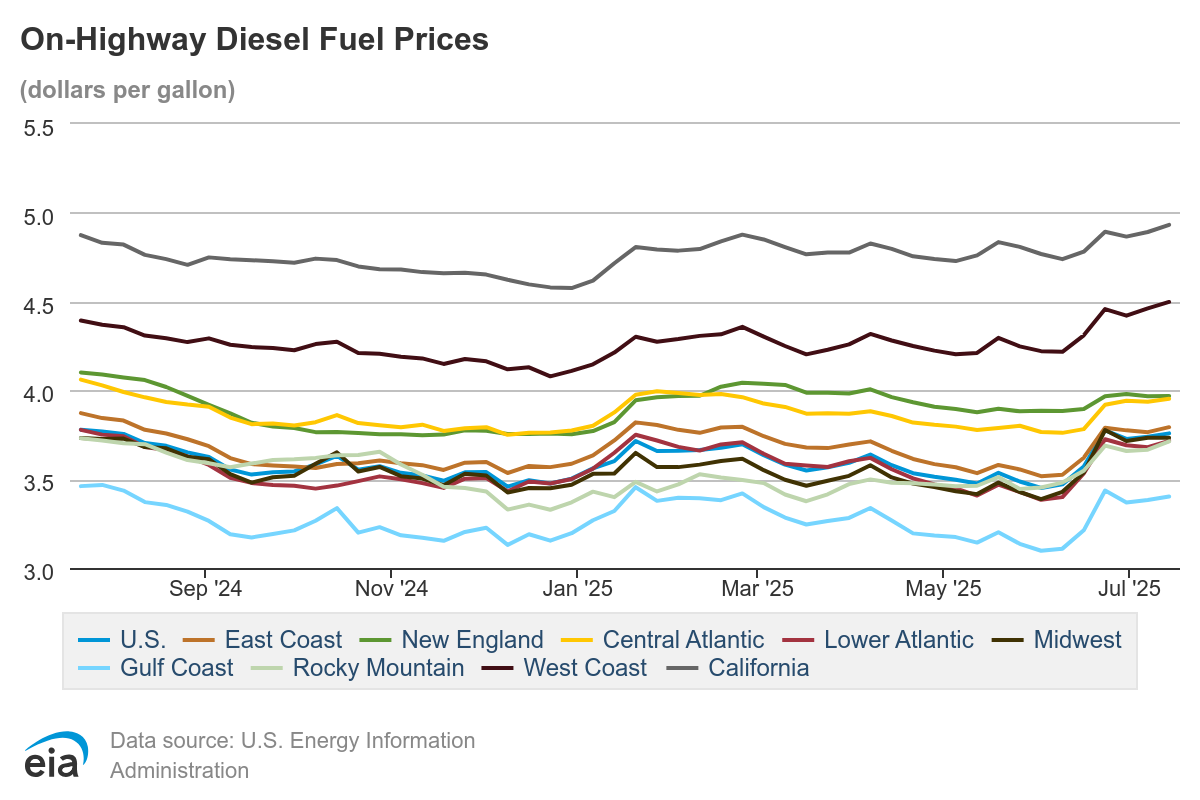

Fuel

https://www.eia.gov/petroleum/gasdiesel/?os=frefapp

The national average price of diesel for the week of June 30 stood at $3.73 per gallon, an increase of 24 cents from four weeks prior at the end of May and down $0.042 from a year ago.

Transportation Capacity

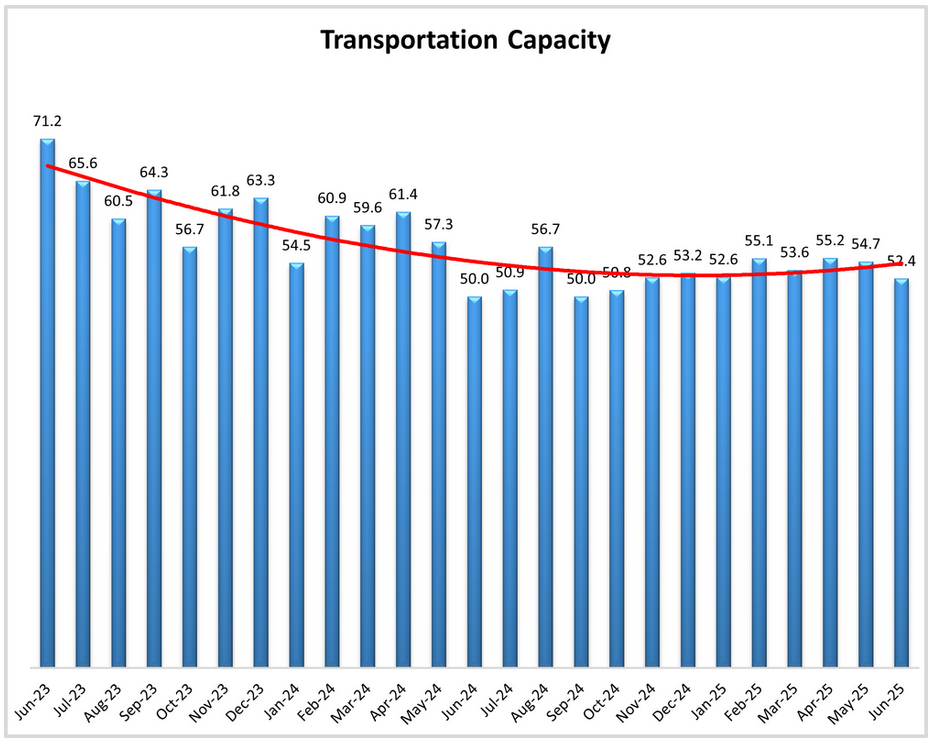

- The Transportation Capacity Index decreased 2.3 points to 52.4 percent in June 2025.

- Transportation Capacity falls to the lowest level recorded in the last 12 months, but is 2.4 points higher than the same month’s reading from last year. As such, the Transportation Capacity index remains in the slight expansion territory. As noted above, Transportation Capacity contracted in the first part of the month (48.1), before moving back into expansion in the back half of June,

- While the Upstream Transportation Capacity index at 50, the Downstream index is slightly higher at 59.6 and the difference is marginally significant.

- The future Transportation Capacity index also ticked slightly lower, and it is now at 45.7, falling below the critical threshold and indicating contraction for next 12 months. While the future Upstream index is at 44.7, the Downstream Transportation Capacity index is at 46.2, and the difference is not statistically significant. Hence, Transportation Capacity is expected to be contracting across the supply chains.

Transportation Prices

June 2025 Logistics Managers’ Index – LOGISTICS MANAGERS’ INDEX

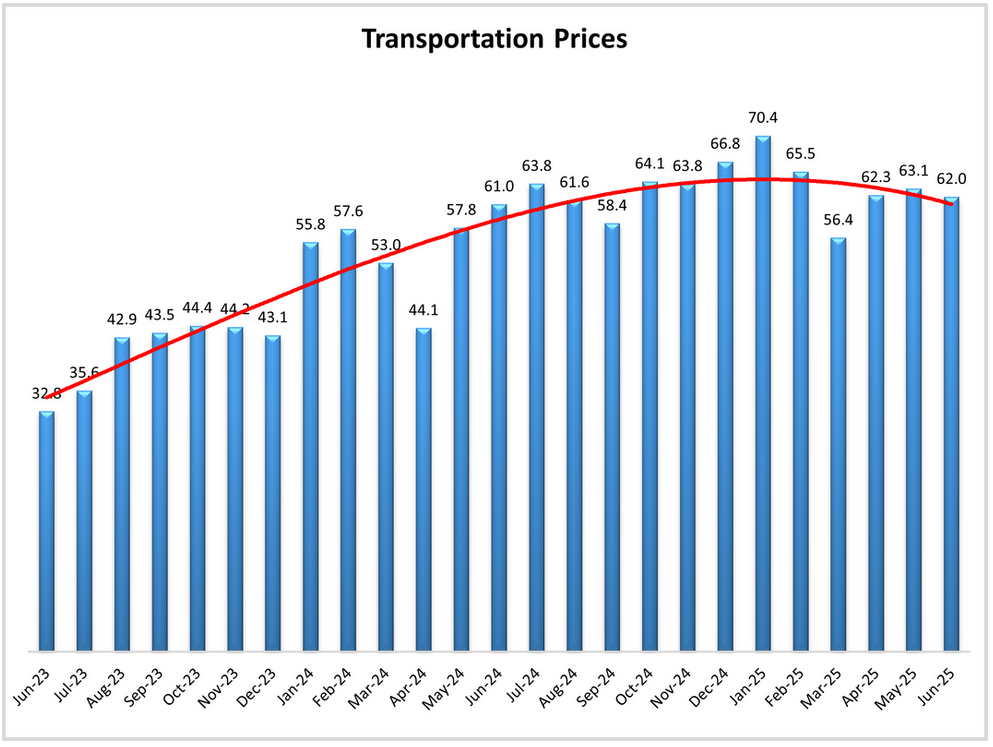

- The Transportation Prices Index increased 1.1 points from the previous reading and recorder 62.0 in June 2025.

- The Upstream Transportation Prices Index is at 61.2, and the Downstream index is at 61.5, indicating that the price increases that we are seeing in transportation for the past 12 months are felt relatively uniformly across the supply chain.

- The future index for Transportation Prices also decreased slightly from last month, indicating 1.7 points lower at 73.3. The Upstream future Transportation Prices index is at 74.0 while the Downstream Transportation Prices index is at 69.2, but the difference is not statistically significant. As such, it can be concluded that expectations of higher Transportation Prices remain prevalent across the economy, up and down the supply chains.

Cass Freight & Truckload Index

Uncertainty Reigns

Source: Cass Information Systems, Inc.

Cass Transportation Index Report | June 2025 | Cass Information Systems

Cass Transportation Index Report | June 2025 | Cass Information Systems

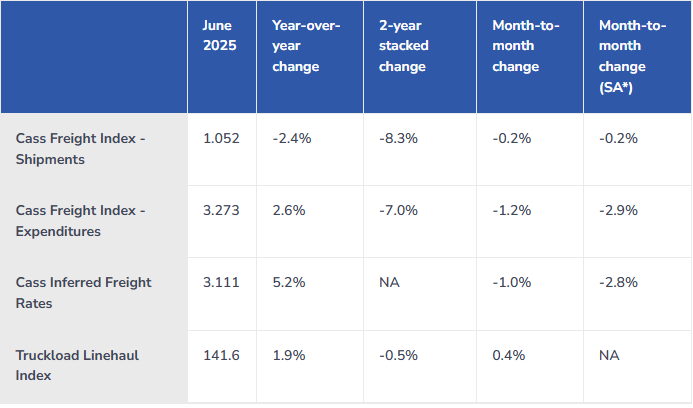

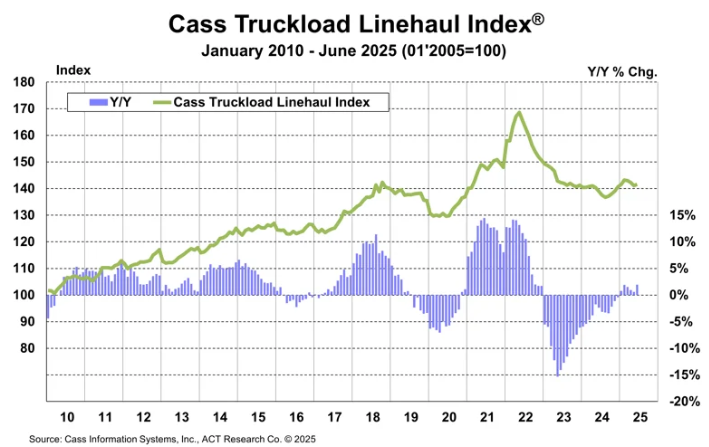

The Cass Truckload Linehaul Index is a measure of market fluctuations in per-mile truckload linehaul rates, independent of additional cost components such as fuel and accessorials.

The Cass Truckload Linehaul Index rose 0.4% m/m in June, after a 0.8% decline in May.

- The y/y increase accelerated to 1.9% in June from 0.6% in May, mainly due to an easier comparison. Pre-tariff shipping has not tightened the market balance even as seasonality improved in May.

- This index fell 10% in 2023, another 3.4% in 2024, and after a 1.3% increase in 1H’25, is on track for a small increase in 2025.

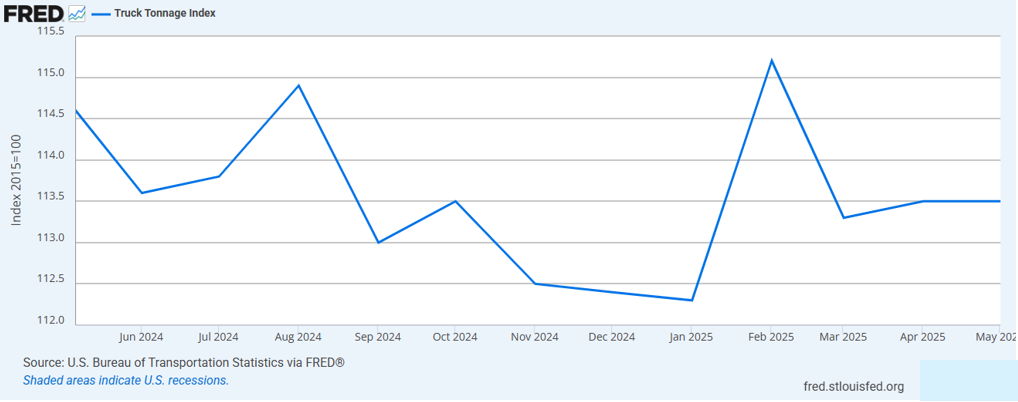

Truck Tonnage Index

ATA Truck Tonnage Index Declined 0.1% in May

From the American Trucking Associations (ATA) on June 26, 2025:

- In May, the ATA advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index equaled 113.8, down from 113.9 in April. The index, which is based on 2015 as 100, was down 1.3% from the same month last year, the first year-over-year decrease in 2025. Year-to-date, compared with the same period in 2024, tonnage was up 0.1%.

- The not seasonally adjusted index, which calculates raw changes in tonnage hauled, equaled 116.2 in May, 2.9% above April’s reading of 112.9.

- Trucking serves as a barometer of the U.S. economy, representing 72.7% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.27 billion tons of freight in 20241. Motor carriers collected $906 billion, or 76.9% of total revenue earned by all transport modes.

- Both indices are dominated by contract freight, as opposed to traditional spot market freight. The tonnage index is calculated on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.

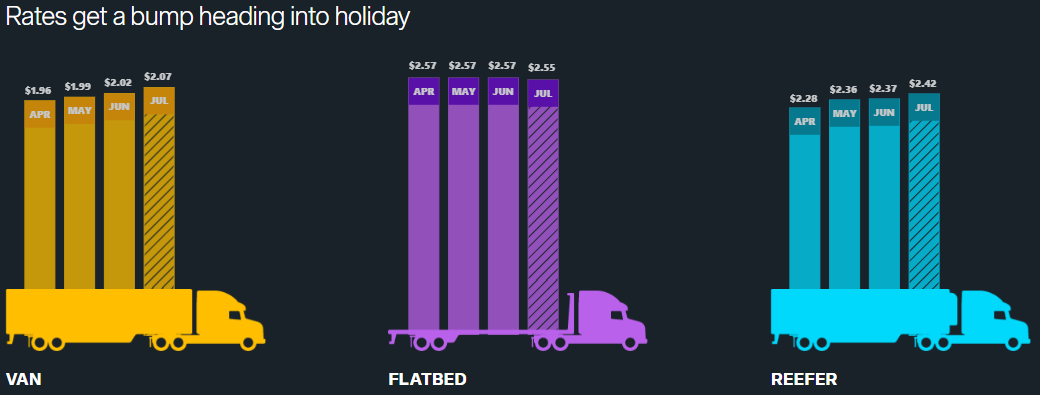

National Spot Rates

Source: DAT Analytics | https://www.dat.com/trendlines

The chart above depicts national average rates (including fuel surcharges) in the past 13 months, derived from DAT RateView.